are charity raffle tickets tax deductible

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status. The IRS has determined that purchasing the chance to win a prize has value that is essentially.

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

What about raffle tickets.

. This is because the purchase of raffle. You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. Although you cant take a tax deduction for purchasing a raffle ticket you could deduct the amount spent on losing tickets as long as you had at least that amount of gambling winnings.

Because no part of the purchase. Furthermore charitable raffle tickets are generally tax-deductible if the fair market value of admission to the event determines the ticket price. Porte Brown answers the most common questions regarding charitable contributions.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The irs has adopted the position that the 100 ticket. What you cant claim.

You cant claim gifts or donations that provide you with a personal benefit such as. 495 37 votes. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372.

For information on how to report gambling winnings and. Are fundraisers tax deductible. The purchase of a raffle ticket is not considered a charitable donation.

Is a public charity and educational program recognized under irs code 501c3. Are tickets to a virtual charity event tax. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by.

To claim a deduction you must have a written record of your donation. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over. If the organization fails to.

An organization that pays raffle prizes must withhold 25 from the winnings and report this. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. This might sound nonsensical on the.

The cost of a raffle ticket is not deductible as a charitable contribution even if the. However the answer to why raffle tickets are not tax-deductible is quite simple. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling.

When you purchase a ticket to a charitable fundraising event such as a dinner some or all of the price you pay can be a deductible donation as well. Withholding Tax on Raffle Prizes Regular Gambling Withholding. A gala dinner costs 100 per person for.

Fundraising Events And Cause Related Marketing Pdf Free Download

Winning Scc 50 50 Raffle Ticket News Media Las Vegas Motor Speedway

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible

Rotary Rocks The Raue 50 50 Raffle By Rotary Club Of Crystal Lake Dawnbreakers Charity Betterunite

Autograph Football Derek Carr 4 Raffle Ticket 5 00 Overflow Sports Academy

Are Nonprofit Raffle Ticket Donations Tax Deductible

12 Tips For Making Your Charitable Donation Tax Deductible

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Charitable Deductions On Your Tax Return Cash And Gifts

Alternatives To Raffle Events Givesignup Blog

Canaan S Classic Charity Disc Golf Tournament

Autograph Football Derek Carr 4 Raffle Ticket 5 00 Overflow Sports Academy

Are Raffle Tickets Tax Deductible The Finances Hub

50 50 Raffle Chester County Community Foundation S Blog

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic

Are Nonprofit Raffle Ticket Donations Tax Deductible

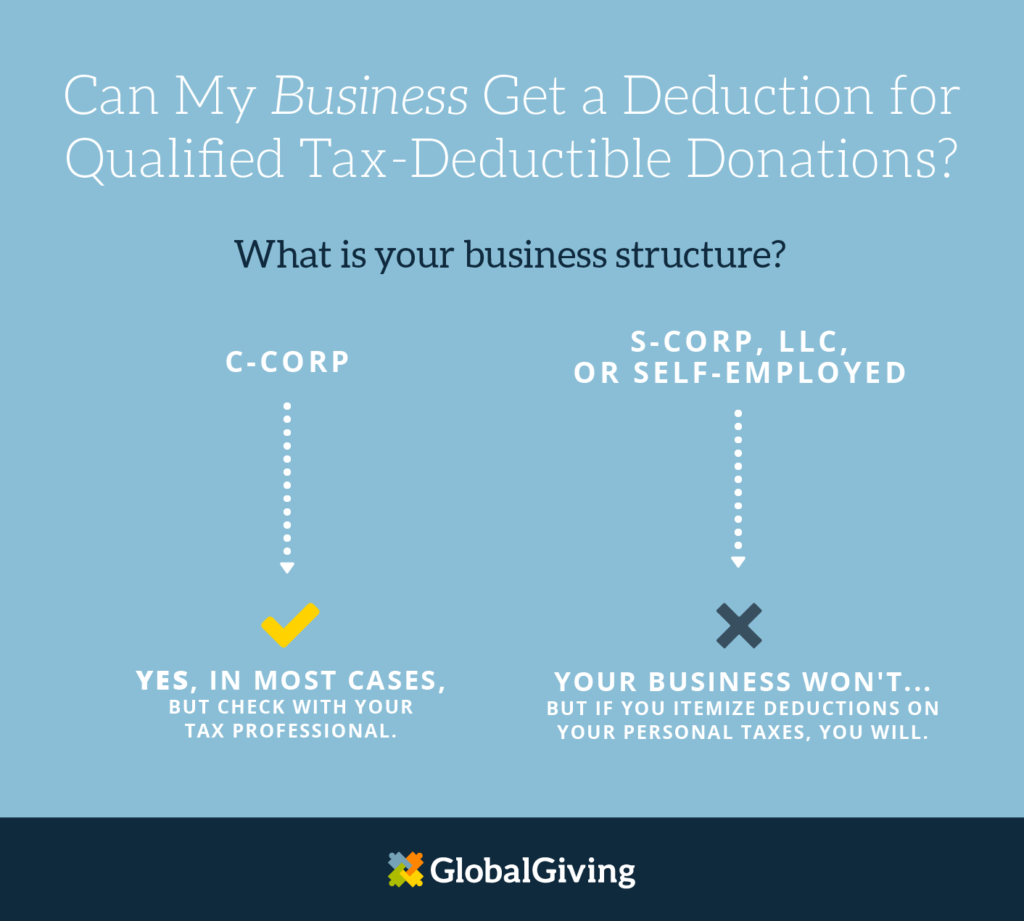

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving